Understanding each section of your monthly credit card statement is key to managing your credit card account and finances. Reviewing your monthly statement can help you balance your budget and ensure there are no errors or fraudulent charges.

But how do you navigate a credit card statement? Follow our easy-to-read guide and learn how to locate transactions, payments, your credit score, and more. Using a Discover® credit card statement, we’ll also help you decode the terminology, numbers, and interest rates that make up your statement. And while not all statements look the same, most include basics like account information, payment due date, transaction history, and credit limit information. So, let’s get started.

How to Read a Credit Card Statement

Key points about: reading your credit card statement

-

A credit card statement offers a monthly or yearly recap of your account activity and is available online or by mail.

-

A credit card statement usually includes categories that document your available credit, amount due, due date, credit score, transaction history, and more.

-

Carefully reviewing your credit card statements can help you manage your spending and catch fraudulent charges.

What is a credit card statement?

Think of a credit card statement as an in-depth summary of how you’ve used your credit card throughout a billing cycle. Once a month, your credit card issuer will issue a new statement packed with important details such as your transaction history and payment due date. Some credit card statements also include information about your credit score.

Your most recent credit card statement should be available online (by logging into your account) and by mail (based on your paperless billing preference). Your credit issuer must send your statement at least 21 days before payment is due per the Office of the Comptroller of Currency.

At an overview, you’ll most likely see your statement broken into sections with headers that indicate what each section contains.

Breaking down your monthly credit card statement

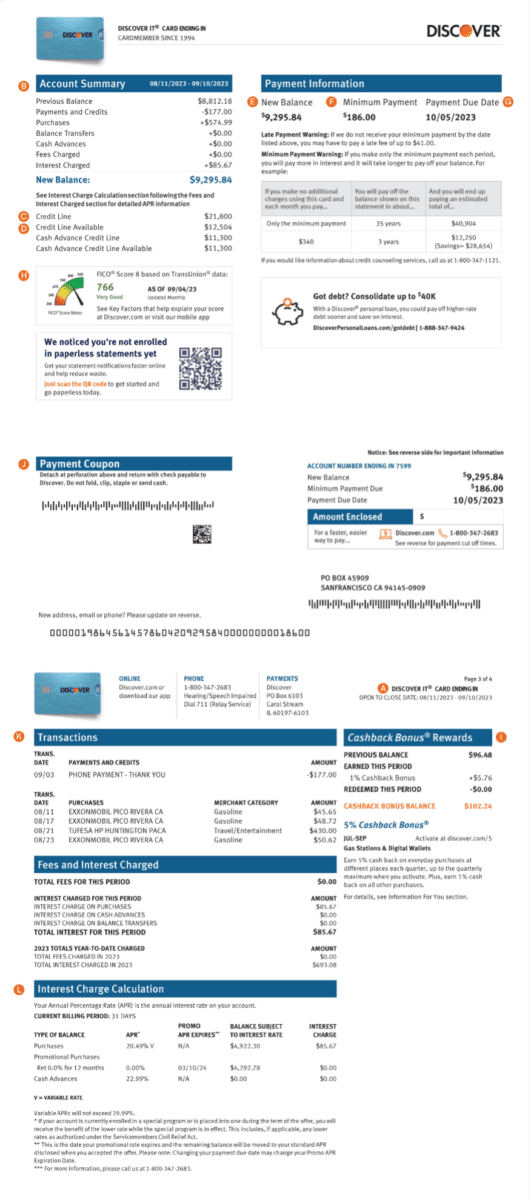

Using the overview of our example statement, you can learn about each lettered section by finding the corresponding letter that explains it below.

A. Account information: This section includes some of your basic account information, like the last four digits of your account number.

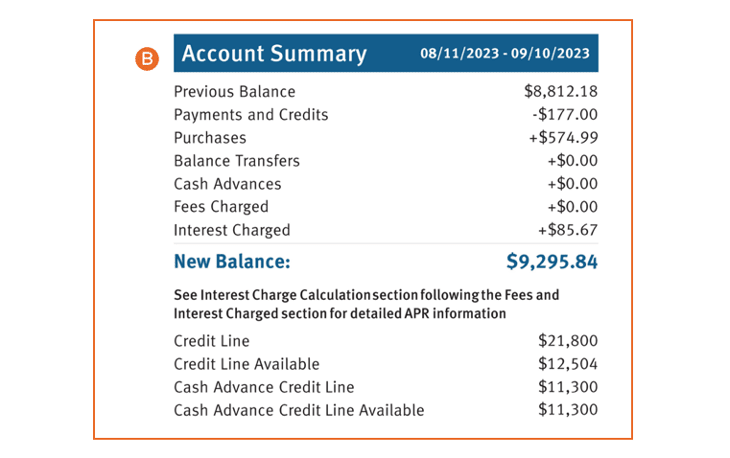

B. Account summary: An account summary often includes your billing cycle's start and end date, the previous balance from the last billing cycle, and a list of the sums for each transaction category within the current billing cycle. Categories may include payments and credits, purchases, balance transfers, cash advances, fees, and interest charges. An account summary also provides credit line information.

C. Credit line: Your credit line represents your spending limit.

D. Credit line available: Your available credit equals your credit limit minus your outstanding balance (purchase amounts, cash advances, and applicable interest and fees).

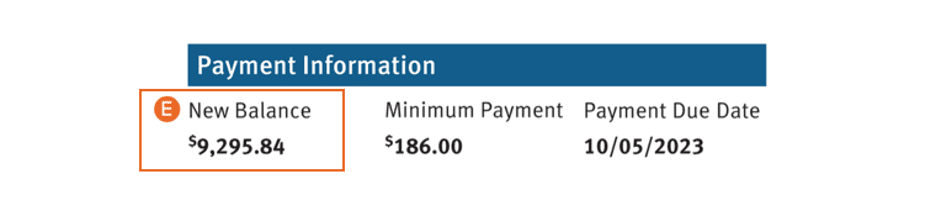

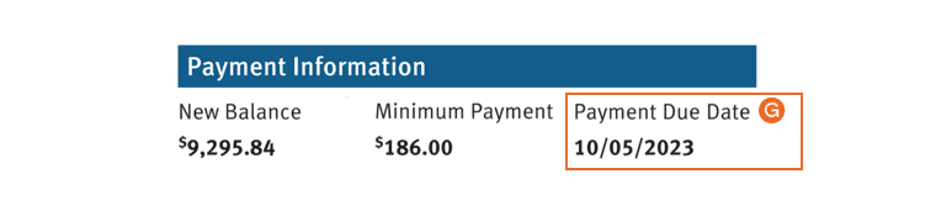

E. New balance: The payment information section of a credit card statement should list your new balance. Your new balance represents the amount of credit you’ve used plus any fees and interest as of the statement close date.

F. Minimum payment due: The payment information section of a credit card statement should also list your minimum payment due. You must pay at least this much by the payment due date to keep your account in good standing. But you can always pay more than the minimum, up to the total balance.

G. Payment due date: You should find your payment due date in the payment information section of a credit card statement.You'll likely get charged a late fee if you don't pay the minimum amount by the due date, and paying your credit card late can have other consequences.

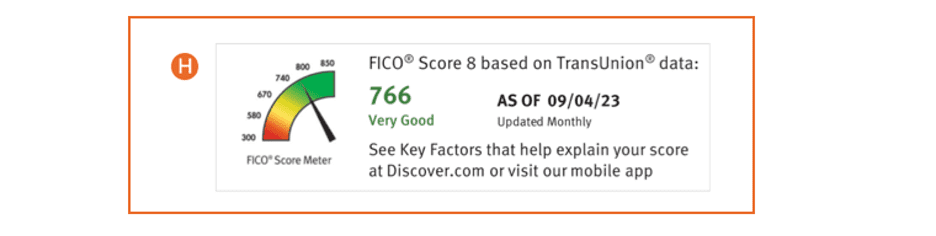

H. Credit score: You may find your credit score under the Account Summary section of your credit card statement. 90% of top lenders use FICO® Credit Scores, including Discover.1

Your credit score is a three-digit number that grades the information on your credit report—the higher the number, the better your credit. Lenders use your credit score to assess your reliability as a borrower, which can influence the approval and terms for car loans, mortgages, credit cards, and more

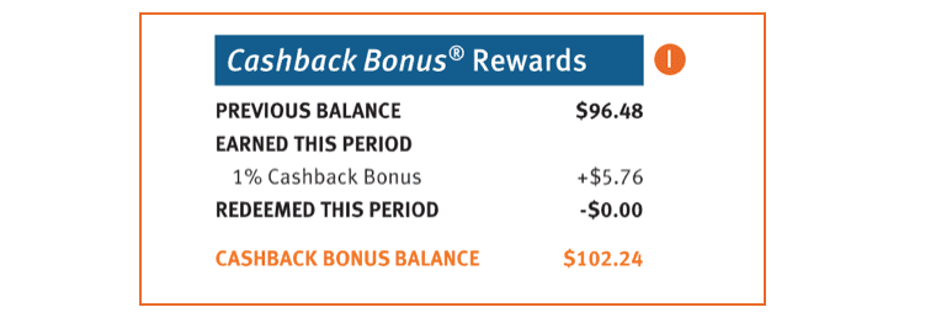

I. Rewards: The rewards section of your credit card statement should document the amount of cash back, miles, etc., you’ve accrued previously and how much you’ve accumulated in your current billing cycle.

Did you know?

Every Discover Card earns rewards on purchases. Choose the card that earns the type of rewards that are most valuable for you.

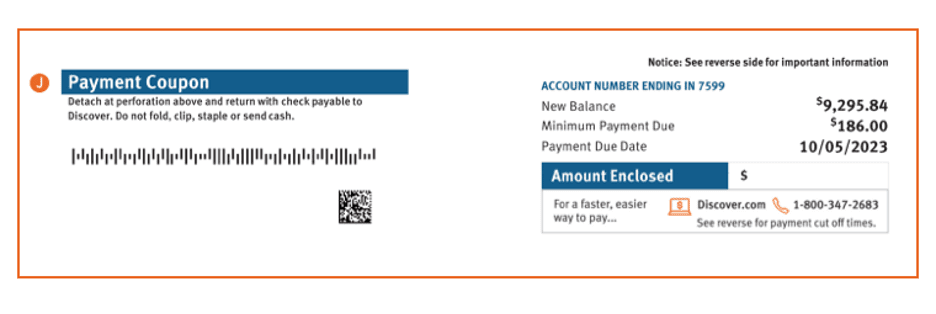

J. Payment coupon: If you opt for a paper statement, it’ll likely have a payment coupon to include with your check if paying by mail. All the necessary payment information will appear on the coupon.

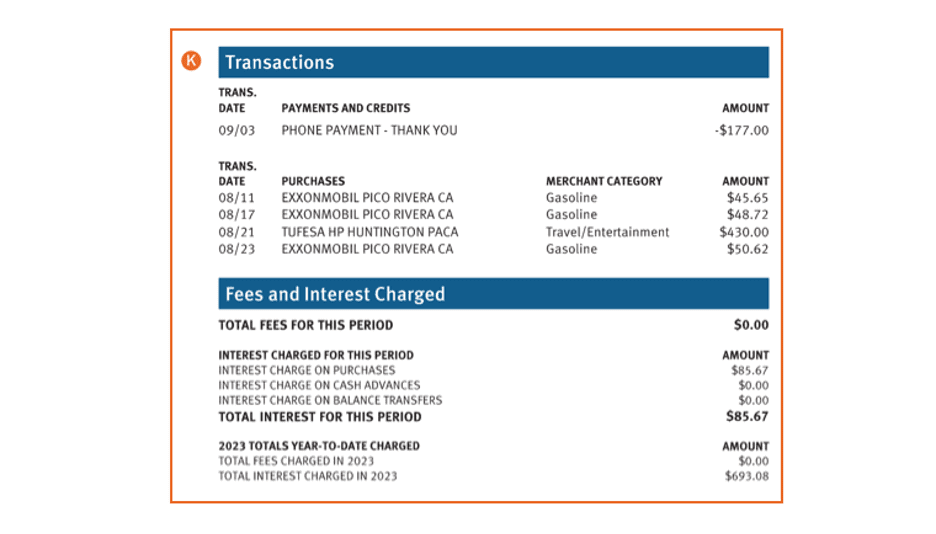

K. Transactions, fees, and interest: In the transactions section, you'll find the breakdown of each charge and payment for that billing cycle, listed by date.

A credit card statement's fees and interest section will show you what, if any, fees or interest you have incurred during your billing cycle and your total fees and interest for the year.

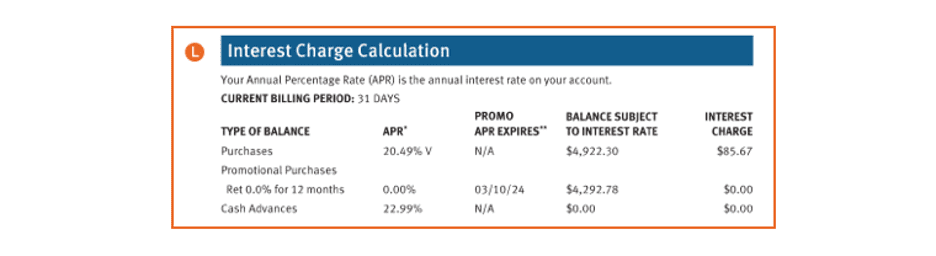

L. Interest type and charges: Your credit card statement might include a breakdown of your interest charges by transaction category and relevant interest rate, like in this interest charge calculation section.Here, you’ll find the annual percentage rates or APRs (for example, purchase APR and cash advance APR) that currently apply to your account, the balances subject to those rates, and the interest charges.

This section may also document what type of APR you have, a variable (fluctuates) or fixed (usually remains the same). Most credit cards offer a variable rate.

Understanding your credit card statement balance

Your credit card statement balance reflects what you owe your card issuer as of the close of your billing cycle (when your billing cycle ends, and your balance gets reported to credit bureaus).

Remember: a credit card statement balance is just a snapshot of one billing cycle. On the other hand, your current balance is like a live feed of your account information. It may show a different amount than your credit card statement balance because of transactions made, and fees charged since your last statement was published.

Your credit card statement balance is the number you should pay off every month to avoid interest. If you think you may miss your statement, you may want to set up automatic bill pay to avoid paying late.

Understanding your year-end credit card statement summary

Along with a monthly credit card statement, you should receive a year-end statement from your credit card company outlining your card activity for the calendar year.

After the year rolls to a close, your year-end statement summarizes the total amount of your purchases, cash advances, and balance transfers for the year. These figures may not reflect your current balance, but they can offer a helpful view of credit card activities for the year.

Your year-end statement may also sort your yearly transactions into spending categories.Sorting your transaction totals can offer a useful overview of your spending patterns, allowing you to see where you’re on track with your budget and where it may need work. Sorting transactions can also help you find tax-deductible expenses. This may be particularly helpful for someone who is self-employed and using their personal credit card for business expenses.

Whether a monthly or year-end statement, understanding how to follow and process your statement details can help you better manage your spending, payments, and even your taxes. Use this guide as a resource for decoding your next credit card statement.

Next steps

See rates, rewards and other info

You may also be interested in

Was this article helpful?

Was this article helpful?

-

FICO® Credit Score Terms: Your FICO® Credit Score, key factors and other credit information are based on data from TransUnion® and may be different from other credit scores and other credit information provided by different bureaus. This information is intended for and only provided to Primary account holders who have an available score. See Discover.com/FICO about the availability of your score. Your score, key factors and other credit information are available on Discover.com and cardmembers are also provided a score on statements. Customers will see up to a year of recent scores online. Discover and other lenders may use different inputs, such as FICO® Credit Scores, other credit scores and more information in credit decisions. This benefit may change or end in the future. FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

Discover Financial Services and Fair Isaac are not credit repair organizations as defined under federal law or state law, including the Credit Repair Organizations Act. Discover Financial Services and Fair Isaac do not provide “credit repair” services or assistance regarding “rebuilding” or “improving” your credit record, credit history or credit rating.

-

Legal Disclaimer: This site is for educational purposes and is not a substitute for professional advice. The material on this site is not intended to provide legal, investment, or financial advice and does not indicate the availability of any Discover product or service. It does not guarantee that Discover offers or endorses a product or service. For specific advice about your unique circumstances, you may wish to consult a qualified professional.